The IPO of Indian Railway Finance Corporation came on 28 January 2021 and this IPO was allotted to many people in India. Many people kept IRFC’s IPO in their portfolio for a long time and IRFC shares have also given them huge profits.

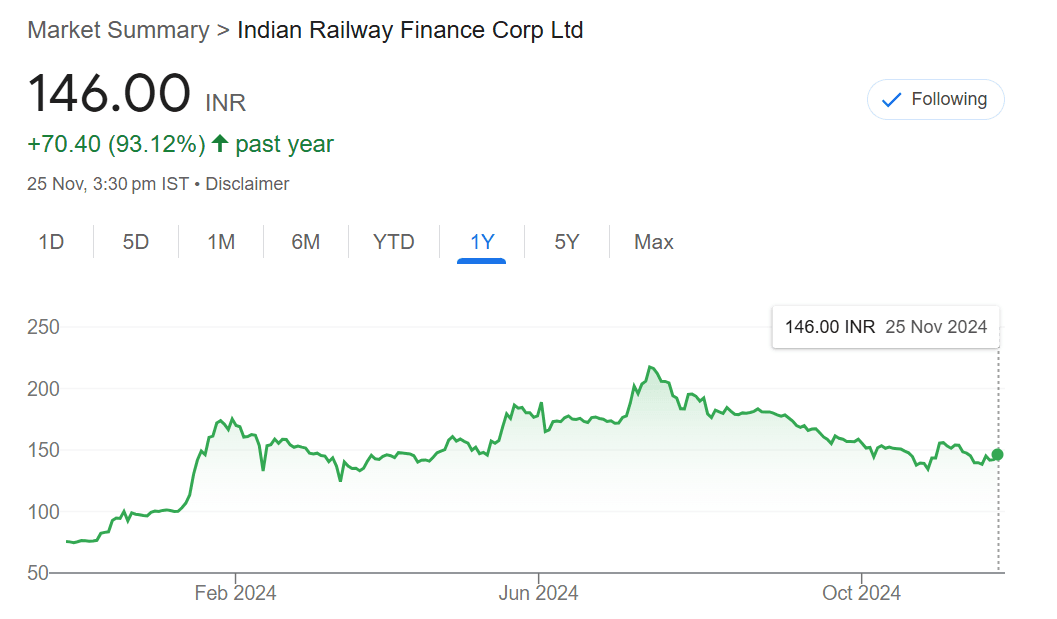

IRFC’s IPO came for Rs 4,633.38 crores and its base price was only ₹ 26. Right now in 2024, the share price of Indian Railway Finance Corporation is Rs 146.00, that is, IRFC has given a return of up to 500% so far and has made its investors happy. Today in this article we will give information about the IRFC Share Price Targets for 2024, 2025, 2026, 2027, 2028, 2029, and 2030.

About Indian Railway Finance Corporation (IRFC)

Established in 1986, the Indian Railway Finance Corporation (IRFC) is a public-sector enterprise fully owned by the Government of India. Its core mission is to provide financial support for the Indian Railways by funding the acquisition of rolling stock assets, leasing railway infrastructure, and lending to organizations under the Ministry of Railways (MoR). As the financial arm of Indian Railways, IRFC plays a pivotal role in raising funds required to procure, improve, and expand rolling stock assets, including wagons, trucks, electric multiple units, locomotives, and coaches.

IRFC operates on a financial leasing model, with a lease tenure of 30 years, to facilitate the acquisition of rolling stock assets. In the fiscal year 2019, Indian Railways’ total capital expenditure reached ₹1,334 billion, of which IRFC contributed ₹525.35 billion—representing 39.34% of the total expenditure.

IRFC Share Price Target 2024, 2025, 2026, 2027, 2028, 2029, and 2030

| Year | 1st Targets (₹) | 2nd targets (₹) |

| 2024 | ₹142.56 | ₹173.45 |

| 2025 | ₹183.67 | ₹217.80 |

| 2026 | ₹229.33 | ₹250.35 |

| 2027 | ₹286.30 | ₹301.00 |

| 2028 | ₹335.45 | ₹398.55 |

| 2029 | ₹459.90 | ₹511.34 |

| 2030 | ₹769.87.30 | ₹1012.25 |

IRFC Share Price Chart Last 1 Year

IRFC Share Fundamental analysis

Market Capitalization: ₹1,91,192.24 Cr

Advances: ₹0 Cr

Number of Shares: 1,306.85 Cr

Key Ratios:

- Price-to-Earnings (P/E): 29.36

- Price-to-Book (P/B): 3.72

- Face Value: ₹10

- Dividend Yield: 1.06%

- Book Value (TTM): ₹39.38

Financial Performance:

- Operating Revenue: ₹26,644.58 Cr

- Net Profit: ₹6,412.55 Cr

- Earnings Per Share (EPS – TTM): ₹4.98

Growth and Returns:

- Sales Growth: 12.32%

- Profit Growth: 3.97%

- Return on Equity (ROE): 13.66%

- Return on Capital Employed (ROCE): 5.73%

Ownership Structure:

- Promoter Holding: 86.36%